Dont let tax time overwhelm your shop

It’s that time of year again. You know the drill. You hope to pay as little as possible while staying within the rules. Your CPA, accountant, enrolled agent or tax…

It's that time of year again. You know the drill. You hope to pay as little as possible while staying within the rules. Your CPA, accountant, enrolled agent or tax preparer does the calculating, then gives you the results and you write out the checks. This year, don't just comply with his or her instructions. Make the exercise a painless process as well as a learning experience. Here's how to go about it:

{loadposition position10}

Don't make your accountant the bookkeeper. Keep the books yourself using a computer software program or hire someone so that the accountant can come in and work with the summaries. One possibility is that the accountant trains a staffer to keep the books. This separation of paperwork and interpretation will save you quite a bit of money.

Estimated taxes are an educated guess at how much you will owe at the end of the year. If you don't put in enough estimates, you will be penalized. So be sure to put in on the correct due dates - April 15, June 15, Sept. 15, and Jan 15 - 100 percent of what you will owe or not less than 90 percent of last year's tax liability. If you comply with either or both of these rules, you won't be penalized. But the penalty isn't the worst problem. It's easy to get behind the 8-ball at tax time, making one work hard to catch up. So if you suspect you're making more profit this year than last year, put in extra amounts in the last two estimates, so the liability will be minimal.

Set up a home office in your home and obtain a write-off. Since millions of employees work at home, what used to be a red flag is now a commonplace strategy. Most woodworkers could comply by setting up a desk in a room and using the space to do paperwork regularly and exclusively. Regularly means that you are there on a fairly consistent basis and exclusively means that area is used pretty much for the affairs of your business.

The home-office deduction allows you to deduct a percent of home costs (mortgage, taxes, insurance, maintenance/repairs and depreciation) as an expense on Schedule C and as a job expense on Schedule A (if incorporated). The percentage is determined by the square footage of your home office divided by total square footage of your house. So if it costs $30,000 to maintain a house and your home-office calculation is 15 percent, you have a $4,500 deduction. A relatively new provision of the square-footage determination is that you can include storage or record space, even if it isn't regular and exclusive. So if you store wood in your garage, you can add that space into the computation.

Because of your home office, you can now deduct commuter mileage. Commuting back and forth from work is generally not a deduction, but because your home office is now your principal place of business, all miles to and from count. So if you drive 30 round-trip miles six days a week, that's about 9,000 commuting miles a year, which would result in a $4,500 expense.

Include travel that could be related to business. Go to conventions. Attend association meetings. Visit other woodworking shops. Combine business with pleasure on vacations. Some of the expenses associated with this travel could be deductible as long as there is a business component. So if you take a road trip, but visit several shops, some of the cost could be a travel expense. Your accountant should make the determination. For example, only your portion of cost could be included as an expense, not your spouse.

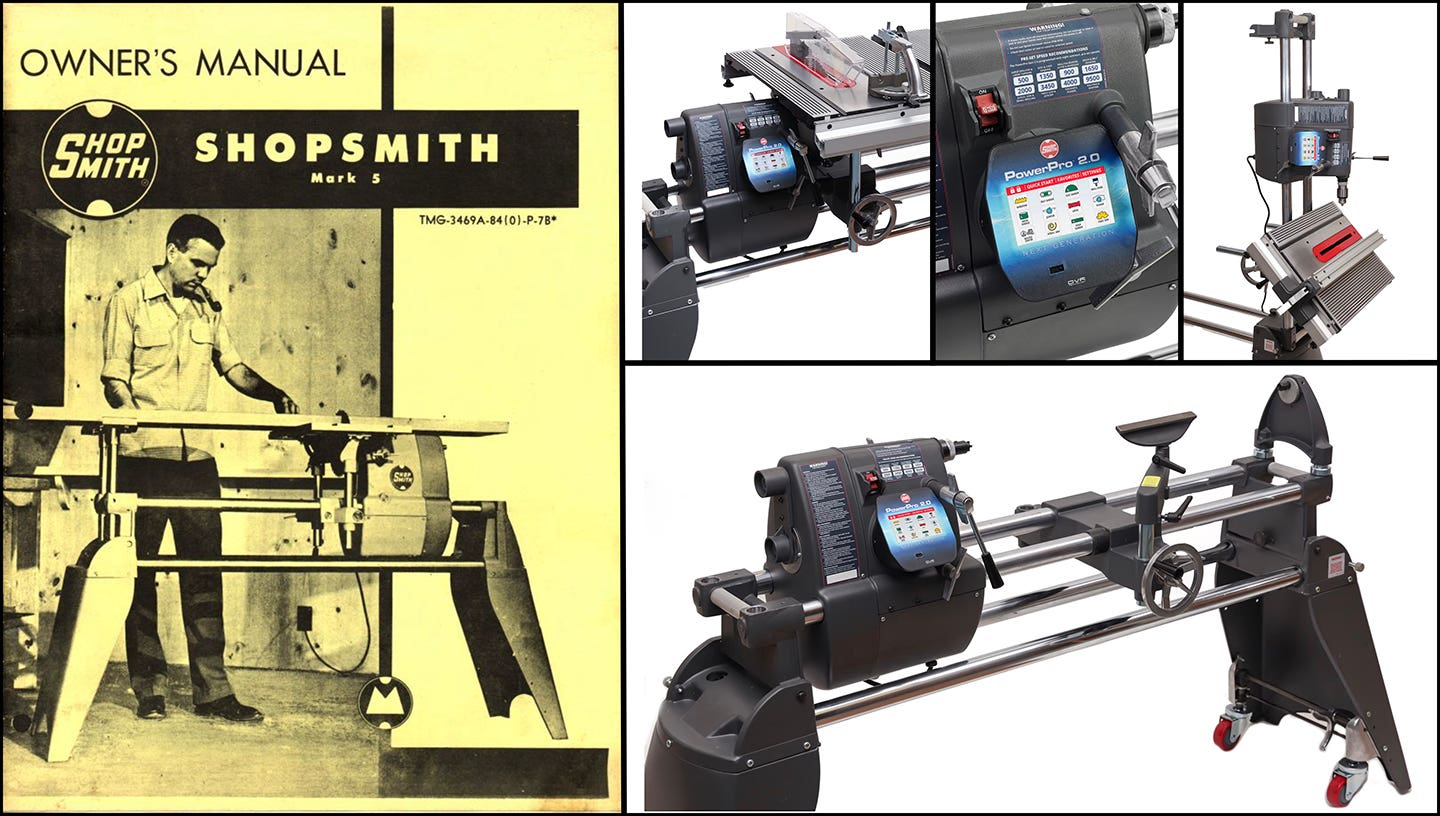

Use Section 179 to take full capital deductions up to $250,000. Purchase new equipment this year such as a straight rip saw or an air dust system? The costs are typically allocated over time (usually five to 10 years) or can be, through Section 179, taken in full in the year of purchase. So if you're showing too much profit, you might reduce the sum by taking off 100 percent of the capital purchase. It's a judgment call between your cash flow needs this year and anticipated profits in the future.

Hire your children and gain a write-off. You could hire your children, pay them up to $5,700, take out Social Security, but they wouldn't have to pay income taxes because the amount is under the standard deduction. In this way, the company receives a write-off and your children learn the value of hard work. Of course, they do have to work.

Re-examine the rent-versus-own decision of your property. Times change and what was a prudent decision a few years ago might be foolhardy now. If you've owned the property for years, this might be a good time to sell and arrange a long-term rental contract to continue to occupy your space. If you've been renting, building values are really low today. This might be a perfect time to buy and increase your deductions. It pays to sit down every few years and re-examine this issue.

Search for other expenses: If you search through your checkbook, you will probably find other deductions. Such charges as professional subscriptions, Rotary memberships, taking staffers out to eat, helping employees in other ways and donating pizzas for town races and the like are often overlooked. One woodworker donates wood to a Habitat for Humanity house each year. He could take the cost of this wood as a donation expense.

Take advantage of the self-employed health insurance deduction. Self-employed owners are allowed to deduct 100 percent of their health insurance premiums. It appears as a deduction in the adjusted-gross-income section of your 1040. This is a dollar-for-dollar reduction of income, so it is not to be missed. Of course, if you're incorporated, your health insurance will be a fully deductible expense.

Have your accountant explain the income and balance statements. Don't just write a check. Make your financial expert show you why profits were down, what the depreciation charge consists of or why cost of goods sold were 25 percent of last year's total. In the after-tax review, arrive with a list of questions. Is it time to buy a new truck? How can I take advantage of the Internet? What commercial business should I stay out of? What can I do to tighten collections? As a corollary, your accountant should be familiar with the management issues you face. It's up to you to get him or her involved. Have them visit your shop. Send them marketing information. Stay in touch with periodic phone calls or e-mails.

Ask what else the accountant can do for you. Remember, your accountant is also a savvy businessman. Can he or she help you hire a key manager? Do they have any advice on resolving an employee dispute? If their clients include other woodworking shops, can a comparative evaluation be printed without revealing names? Would it be beneficial to set up an ownership group? What about advice concerning retirement planning or advice to get you through a difficult divorce.

Tap all of your accountant's knowledge and do this at tax time to get all your money's worth.

This article originally appeared in the February 2011 issue.