Read my lips: Tax incentives are everywhere for woodworkers

In 1973 the finance minister in Ireland, Richie Ryan, came up with a good idea. (As he presided over a very severe recession, most Irish people say it was the…

In 1973 the finance minister in Ireland, Richie Ryan, came up with a good idea. (As he presided over a very severe recession, most Irish people say it was the only good idea he ever had.) What he devised was something that accountants now call a patent box. He persuaded his colleagues to pass a bill that in essence would exempt from Irish income tax any earnings from patents that were first recorded in Ireland.

Here’s how Bloomberg described the results in August: “This innovation arguably laid the foundation for a resurgence of the economy in the 1980s and 1990s, when high-tech corporations moved to Ireland in droves to take advantage of the generous tax breaks. And it has become a model for nations everywhere eager to lure intellectual property.”

Even after the viscous recession that began in 2008, nine of the top 10 U.S. high-tech companies still have a major presence in Ireland. And this tiny country with a national population smaller than the Boston metro area is still ranked first in the world in the ability to add value to information and communication technology.

So what has an unpopular politician in Europe got to do with running a woodworking shop in North America? Well, he proves that tax incentives can work. Sometimes.

Woodshops and incentives

Back in 2012, Dirk Auferoth decided to apply for tax incentives from the city of Holyoke, Mass., and the state to help him expand his woodshop. Auferoth started his business soon after arriving in the U.S. from Lünen, Germany, in 1993. When he filled out the incentive papers in 2012, his business was occupying a 9,000-sq.-ft. rental space. He used personal funds ($461,000) and tax incentives (a $50,000 assessment from the city and another $20,000 in investment tax credits from the state) to purchase 130,000 sq. ft. of manufacturing space in a unused millinery and clothing factory. It was located in the city’s historic canal district. With a public incentive that amounted to about 13 percent of the investment, Auferoth became a landlord. He rented most of the space to other businesses and retained about 20,000 sq. ft. for the woodshop.

Today, Dirk Auferoth & Associates LLC (www.dirkauferoth.com) is a model of success. The shop is a premier architectural interior woodwork, cabinetry and furniture studio that works with architects, designers, developers, builders and select clients throughout New England and the metropolitan New York area. When asked if the program helped and whether he would recommend that other woodshops pursue such a solution, Auferoth replied with a resounding “yes” to both questions.

In May 2014, Sauder Woodworking in Archbold, Ohio, announced an ambitious plan to expand with the help of a 60 percent, seven-year job creation tax credit from the Ohio Tax Credit Authority. The agreement called for an investment by the company of some $4.8 million in new payroll plus a further $13 million in plant investments to create about 150 full-time jobs. This expansion was to facilitate a new contract the company had negotiated with Ikea (for whom it was already producing kitchens) to build four new lines of furniture. Today, Sauder Woodworking (www.sauder.com) markets more than 30 distinct furniture collections in a full line of RTA furnishings. With 2,400 employees, the Sauder family of companies generates sales of nearly half a billion dollars annually.

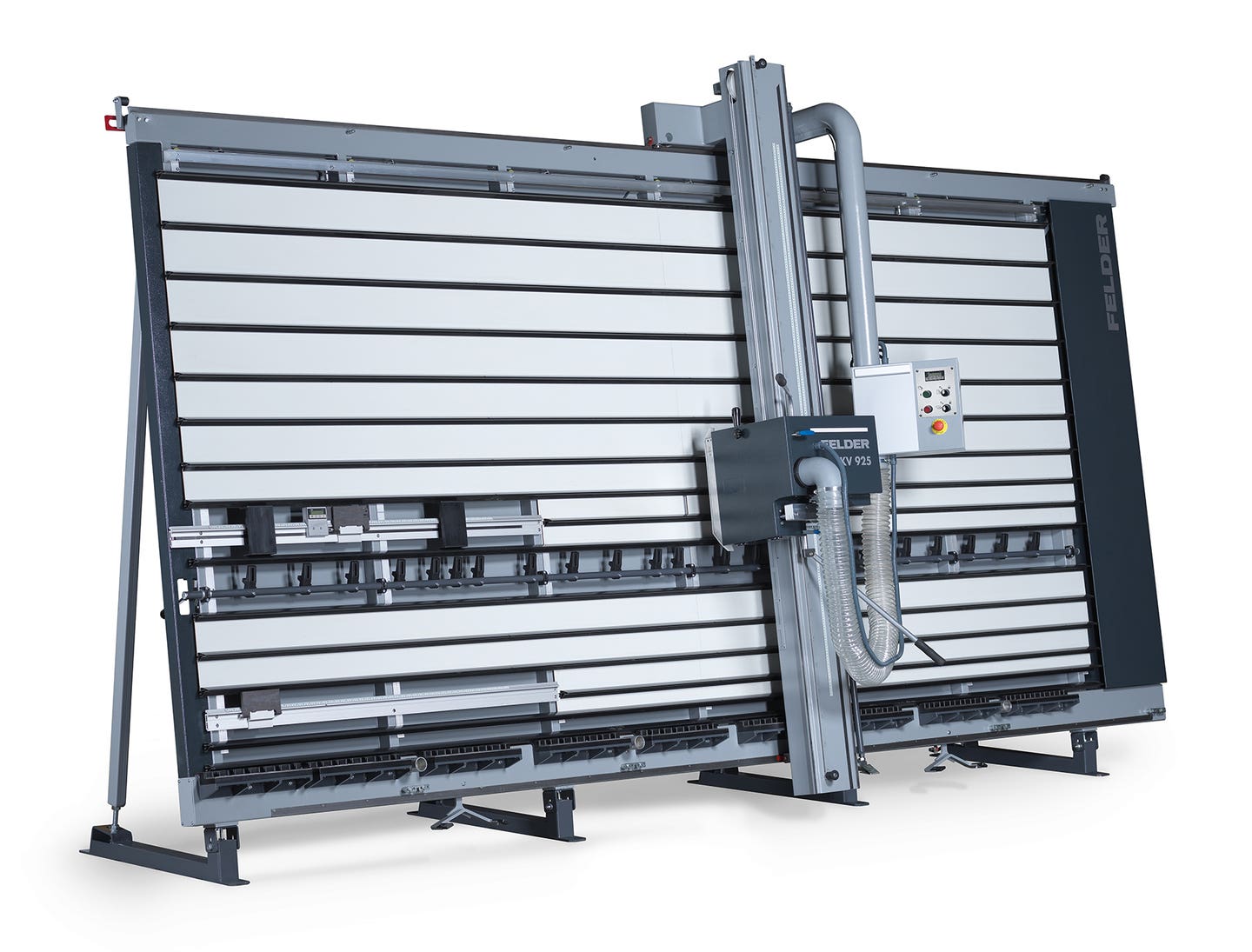

In August, the tax increment financing board in Somerset, Mass., voted to provide an estimated $647,568 in property tax relief over 12 years to Horner Millwork, a subsidiary of North Atlantic Corp. that employs some 300 people. The millwork division (www.hornermillwork.com) was established in 1948 and is now one of the largest millwork and commercial door, frame and hardware suppliers in New England. Under the terms of the tax incentive, the company will pay only 40 percent of the taxes it owes the city during each year of its 12-year expansion. There are some possible state incentives in the pipeline, too. In return, the woodworking company will invest more than $7 million in its Somerset operations, including an additional 20,000 sq. ft. of manufacturing and warehouse space. Horner currently occupies a little more than 200,000 sq. ft. Part of the expansion includes a new 1.2 mW solar plant that will generate most of the shop’s power needs; some advanced equipment for its millwork division that will allow it to work more with bending and other shapes; and a new door machine. Somerset had signed two very successful tax incentive agreements with Horner Millwork in the past, so there was some history to build upon.

The mechanism used here is called a TIF (tax increment financing). It essentially allows a municipality to use future property and other taxes to pay for infrastructure updates and other economic development projects today. Somerset’s TIF board will present the proposed agreement to the selectmen in September and, if approved, it will go on to a special town meeting this fall. Passage at this time seems likely.

Seeking incentives

Cities, counties, states and even the federal government offer various types of incentives to businesses. A big plant in a small town obviously has a louder voice than a small shop in a big city, but most municipalities are very interested in both keeping and creating jobs. (I got my own start in a five-man cabinet shop in rural South Dakota 35 years ago, through a state jobs program that helped pay my wages during training. And I’m still grateful.)

All of the examples above are based on expanding operations and creating new jobs. But depending on where the woodshop is located, protecting existing jobs can also qualify for help.

The first place to visit is your accountant’s office. You’ll probably need some numbers on gross and net profits and wages paid, just to have an initial conversation with any government body and see if you qualify.

Stop at the mayor’s office or visit with a city councilman (or the equivalent) next. Don’t ask what incentives they offer, as many of these programs are off-the-cuff and very customized. Start instead by asking what companies they have helped lately and then ask how. Did they create a TIF? Did they deed a building site or offer a loan or grant? Did they pay part or all of a new hire’s wages? Did they give property tax relief? Keep in mind that you’re not asking for free money. You’re trying to either protect or create jobs and the city has the same goals.

Next, visit your state’s government website. There will be a department called something like economic development or building business and then a page on there that talks about economic incentives. They’re hard to read: you’ll have to wade through a whole pile of self-promotion on most of these sites. It’s funny how every state in the nation is the very best one in which to locate a business.

The local office of the Small Business Administration might know of tax-incentive programs and the business department at a local university will probably have a few pointers, too.

Not just for jobs

On Sept. 2, President Obama became the first sitting chief executive to visit the Arctic. His message in doing so was about global warming. Climate and environmental issues are everyday headlines nowadays and woodshop owners are very aware of various green initiatives. From waterborne finishes to straw-based panels, we live in a changing energy world.

Most states and the federal government now have significant energy-based incentives for businesses, including woodshops. These can help defray the costs of switching to more efficient heating, lighting, cooling, insulation and even transportation. Check with your state’s public utilities commission and you might be surprised at how much help is waiting there for you.

At the federal level, search the database at www.grants.gov for grants that apply to your particular circumstances. After you locate eligible programs, click on Apply For Grants. At the beginning of September, there were approximately 2,000 different grants available and roughly half were for small businesses. So plan on spending a little time online searching for the right ones.

While you’re looking for help sending your employees to school or installing solar panels, you’ll have to wade through a mire of unrelated data. But there are gems in this minefield. For instance, the government has set aside $78 million for renewable energy systems and issues grants from $1,500 to $500,000.

About half the states in the union have some kind of program that offers a tax incentive for recycling. It might apply to wood waste in your state because many programs are based on reusing a waste product (sawdust) to make something new (OSB, wood pellets or perhaps particleboard). If there is a plant nearby that reuses wood waste, ask if they know of any programs. Some of them can be quite complicated, such as Delaware’s recycling employment income tax credit of $500 for each new employee added as a result of incorporating recycled products into a process. A lot of states offer help with purchasing recycling equipment: if your shop creates a great deal of wood waste, this could be worth researching.

This article originally appeared in the October 2015 issue.