Is your business plan on the money?

The new year might be a bumpy one, but it doesn’t necessarily have to be a bad one. 2019 is just around the corner, and woodshops gearing up for it have more to think about this year than most.

The new year might be a bumpy one, but it doesn’t necessarily have to be a bad one. 2019 is just around the corner, and woodshops gearing up for it have more to think about this year than most. The tax code has been changed, interest rates are rising, international trade is in turmoil, machines and software – especially robotics – are evolving at breakneck speed, and the labor market is confusing, to say the least.

Tax changes

This may not be a good year for small shop owners to start handling their own tax returns, especially if they are operating as an LLC or an S Corp. That’s because corporate tax rates have changed to a flat 21 percent, and many pass-through entities are receiving a 20 percent deduction.

Plus, the alternative minimum corporate tax has gone away, and several common deductions are either disappearing or are now subject to much stricter rules. Those include entertainment expenses, interest on business-related loans, and some calendar limits on carrying net operating losses to previous or coming years.

Confused? You’re not alone, but tax preparers generally seem to think that the code is actually less complex than it used to be. The core change for small- to mid-size woodshops will be the pass-through rules.

Credit trends

If you are borrowing to keep the shop’s doors open, the outlook for credit isn’t encouraging. For woodshops that use a lot of credit, the rising trend in interest rates has to be troubling, especially now that a business can only write off interest equal to 30 percent of its adjusted taxable income.

Two years ago, the average for a 30-year fixed rate mortgage was 3.42 percent, according to the Federal Reserve. A year ago, it had crept up to 3.91 percent. This year, it has reached 4.52 percent.

So, mortgage interest expenses have risen about 32 percent in less than two years, and that trend is expected to continue and even accelerate.

The Federal Reserve is reporting that we’re doing more short-term borrowing of late, and the increased demand for this type of loan is also having an effect on rates. Consumer credit increased at a seasonally adjusted annual rate of 4-1/2 percent during the second quarter of 2018. Breaking that down, the use of revolving credit (that is, credit cards and lines of credit) increased at an annual rate of 4 percent, while non-revolving credit increased at an annual rate of 5 percent. The growth is a sign that consumer confidence is high and the economy is expanding, which on the surface sounds pretty good. But many economists argue that increased consumer credit (not actual spending) is a harbinger of trouble.

In 2009, in the wake of the Great Recession, market analyst James Wood pointed out that from the mid-50s to the mid-80s, the total amount of private credit was about equal to GDP. By 2007, private credit was about 178 percent of GDP and much of that debt was not based on a realistic ability to repay it. That particular house of cards collapsed in 2008. From then until 2013, consumer debt shrank considerably. But we have short memories and the latest data from the World Bank says that by 2016 the U.S. domestic credit to private sector (percent of GDP) was already at 192 percent. Americans are going back in the hole, and moves toward deregulation will only accelerate the process and add more risk.

The woodworking industry as a whole is also perking up its ears when the Fed talks. Demand for casework is tied closely to general construction, which is often measured in housing starts, which of course are intricately entwined with a homebuyer’s ability to borrow. As rates rise, two things happen: some potential buyers at the lower end of the housing market are eliminated, and many high-end buyers have to downsize their choices (that is, they order fewer and less expensive cabinets). As woodshops plan for 2019, that’s worth noting, especially for shops that don’t practice strong lean manufacturing and thus hold large inventories.

By the way, inventory is one informal way to predict an upcoming recession. So, keep an eye on the loading dock in 2019. And if you do carry a large inventory, this is a good time to call your insurance agent and ask about coverage. After doing taxes, you’ll be able to supply accurate numbers for the value of that inventory.

Tariffs and trade

While most cabinet shops don’t directly export, they do use a lot of materials and machines that are imported.

So, woodshops have a choice. They can buy all-American made machines (and when one really looks at all of the components and metals used to build them, these are very few and far between), or they can buy mostly U.S. built equipment, or they can grit their collective teeth and pay the tariffs. Either way, the price is going up, so shops planning purchases in 2019 need to plan for that.

Technology 4.0

Anyone who attended AWFS 2017 or IWF 2018 knows where the future lies. Robot arms are everywhere, as is highly sophisticated loading/unloading and stock managing hardware. Every other booth offered some version of new software or phone apps designed to streamline CSR, machine maintenance, inventory or milling operations. Rendered drawings are now photo perfect, and customers can tour a completed kitchen on a screen that is virtually indistinguishable from the real thing.

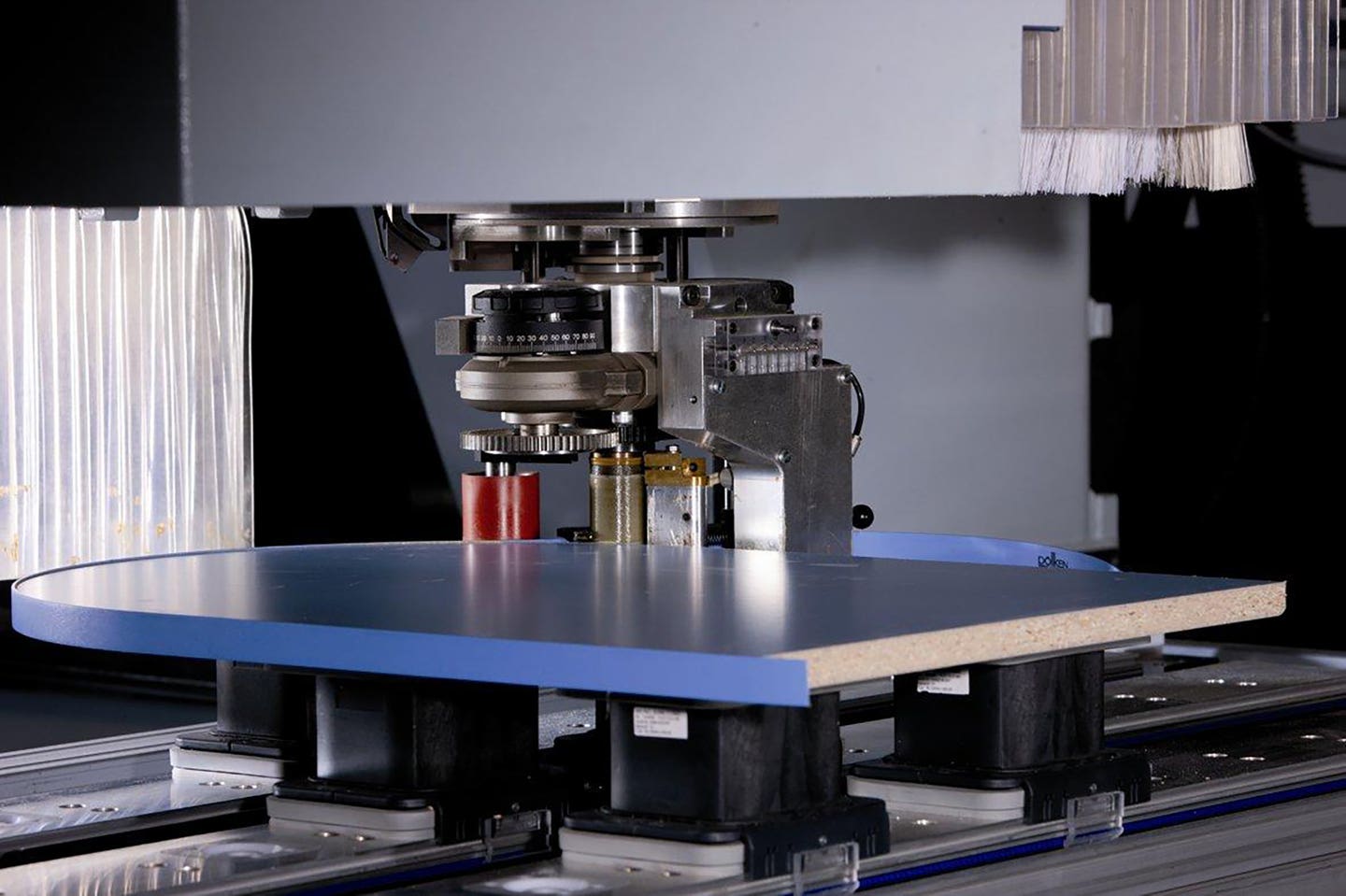

So, what has this to do with a two-man shop in Middle America, and back-office planning for 2019? First off, it enhances opportunities for a more realistic virtual showroom. That’s especially true if the shop’s ordering capabilities are linked to a major outsourcer who uses the same design software to supply casework. Secondly, advances in small to medium platform CNC routers, edgebanders and panel saws can fuel a shop’s growth without adding large numbers of hard-to-find skilled employees, who are becoming very hard to find.

Another aspect of advancing technology, albeit on a physically smaller scale, is the emergence of new fastening and assembly hardware. Companies such as Lockdowel, OVVO, Fastenlink, Häfele America, Titus, Lamello, Kreg Tool, Beadlock, Castle, Fastcap and Festool have all brought new hardware to the market that allows shops to flat ship or assemble onsite, or speed up the assembly process in the woodshop. Most of these innovations come with new software, some involve new hardware, and all of them require some research into the best way that a shop can move forward.

Incorporating a little R&D time in the calendar is a lot less painful these days. An hour or two on a search engine or watching videos can change the way that a woodshop will cut, assemble, finish or outsource. And while Internet is no substitute for walking the halls at a huge woodworking show and meeting the people who create these technologies, it’s a good start. Building an hour or two a week into the schedule just to catch up on the industry (and that, of course, includes reading Woodshop News) will help a shop discover new options. That’s an essential part of planning. It’s hard to reach a destination without looking at a road map.

Insurance issues

One of the pillars of a successful business is risk management, and any good plan has to include several types of adequate insurance. Interruption insurance covers the shop in the case of a major event such as a fire or hurricane that temporarily closes the doors, and you’ll need to ask your agent about terrorism coverage. Commercial auto insurance may be required if employees are driving your vehicles, or their own in the course of their work. Do you know if they’re required to be covered? Property policies can protect the woodshop (including its work-in-progress, tools, equipment and inventory) from theft and damage, but this area is especially sensitive to deductibles. And your mortgage holder may have something to say about reducing the annual premium by using higher deductibles.

Liability coverage deals with lawsuits arising from such things as customers being hurt on the premises, or as a result of work that was done and installed. Then there’s healthcare and Workers’ Compensation, disability coverage, and life insurance for the owners, and perhaps even for some strategic employees. Some of these are compulsory and others are optional, and all need to be discussed once a year with your agent.

That’s because businesses are constantly changing.

Plan on it.

This article originally appeared in the October 2018 issue.