Help the claims adjuster with proper documentation

Job one, of course, is to have your shop, tools, machinery, inventory and other business-related items properly insured. But in event of a claim, a bigger headache might be receiving…

Job one, of course, is to have your shop, tools, machinery, inventory and other business-related items properly insured. But in event of a claim, a bigger headache might be receiving adequate compensation. Job two, then, is to be ready with documentation or proof of what was lost.

The goal is to make it as easy as possible for an adjuster to pay your claim. The adjuster needs documentation of everything you want to be paid for. The better you can document, the better your financial recovery will be. The sooner you provide that documentation, the faster you will receive a check.

Just as you try to work smarter, not harder in your own business, take the same approach here. A little time invested now will usually lead to faster, easier and better settlement.

The process starts by compiling receipts and invoices in an accessible format. What’s accessible? Well, a file folder in your desk drawer won’t help if the shop catches fire. Put them in a fire-proof safe or cabinet, keep a copy offsite, and store on a remove server. The more copies, the better.

Why is that so important? Well, consider trying to prove your losses after a burglary. Everything that was taken is gone and invisible. It will be hard enough for you to remember what was where and what is missing. The adjuster may see only an empty space where there may have been a tenoner, shaper, or rolling tool chest. You will have precious little to document what was there before you went home the night before. After a fire, there may only be a pile of ashes. There may be remains of a table saw but enough to prove its age, quality and cost. Documentation, especially a receipt of the model, date of purchase and value, is that proof.

What if you don’t have a receipt? That’s very common as we all lose paperwork. A manual or tax form, signifying a deduction or depreciation, might suffice. But the best solution is to compile a detailed inventory with photographs. With insurance claims, a picture can be worth a thousand words. The inventory should include the brand, model number, serial number, and any distinguishing features.

This inventory can be completed in a single week using an Excel spreadsheet. It’s best to focus on a category each day, such as:

Monday – List all machinery. Example entry: 10”, 3-hp Delta Unisaw with a Biesemeyer fence and outfeed table; purchased on 8/13/99 at Norm’s Table Saws.

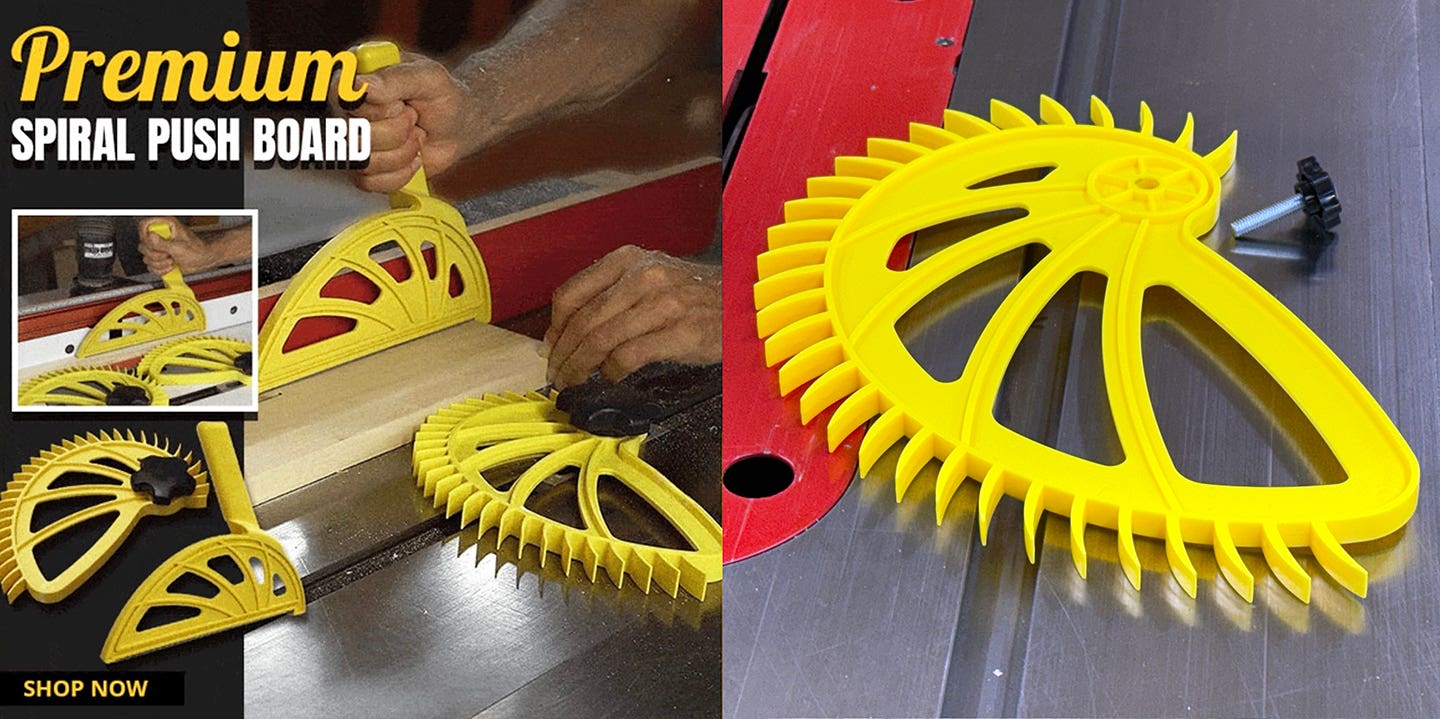

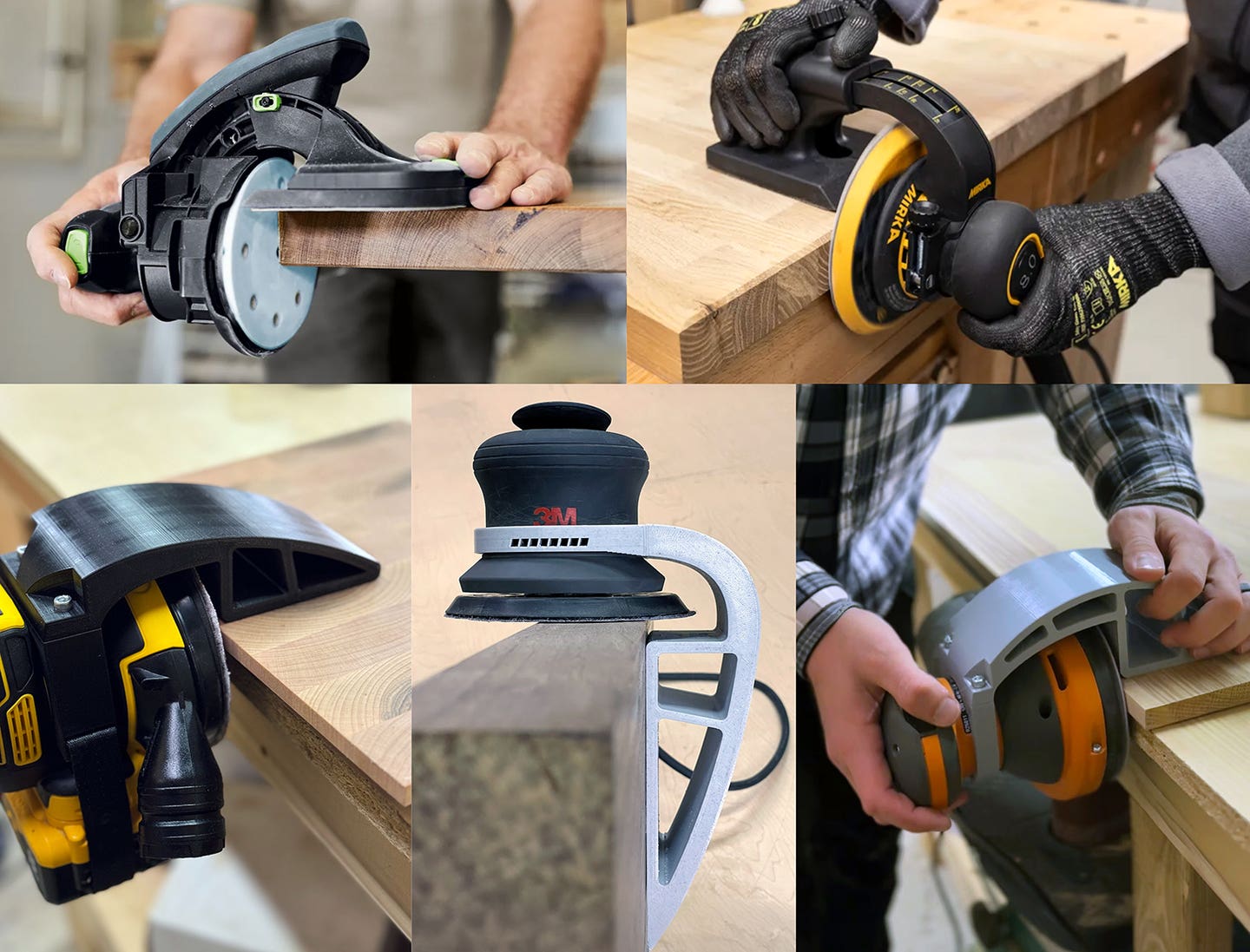

Tuesday – List every hand and power tool with a detailed description. Call out brands, sizes, and specialty items. Remember, while an adjuster might know that old Stanley planes do well at garage sales, they also might have no idea about the value of a Lie Nielson.

Wednesday – List all of your blades, bits, cutterheads and tools that didn’t make Monday’s and Tuesday’s list.

Thursday – List supplies. Inventory will vary but take a few photos when the hardwood racks are full. Don’t forget the hardware bins and finish cabinet. And definitely take a photo of an unusual item – like a 50-gallon drum of adhesive – that will mystify the average adjuster.

Friday – List fixtures, carts, office furniture, showroom pieces, computers, spray booth, lights, dust collection, shelving, etc. Don’t overlook the inexpensive items, which add up quick.

With business interruption coverage, shops are protected from lost profit due to a fire, hurricane or earthquake, for example. So, it’s a good idea to have an accountant review the last 24 months of your Profit & Loss statements.

In the end, the whole process of filing a claim is time consuming. There will nearly always be hiccups and sticking points. Try looking at this as you would any other business relationship. The better your documentation, the easier this will go.

Finally, try to establish a rapport with the adjuster. Who doesn’t make more effort for someone who remembers to say please and thank you?

Keep in mind that the adjuster has a chain of command and needs approval to pay claims. Make the adjuster’s job easier.

Christopher Valvo is retired from a 35-year career in the insurance business, almost all of it as a claims adjuster.

This article was originally published in the April 2021 issue.