Ripped off; a tale of warning

My wifes debit card info was stolen last week, and until things are straightened out were in a bit of disarray. The card wasnt physically taken; the best we can…

My wifes debit card info was stolen last week, and until things are straightened out were in a bit of disarray.

The card wasnt physically taken; the best we can figure is that a nefarious store clerk with a fast memory managed to glance at and remember the card number, expiration date and that three-digit number on the back probably while verifying Sallys signature and write it down. Either that, or someone somehow managed to get that info when the card was swiped through a machine. Sally made several purchases within a few days while traveling last week, and although weve reported those places to the bank its still going to be tough to narrow down.

And then the charges started. All of them, according to the bank, occurred around 1 a.m., a time of day I havent personally been conscious to witness in a long time. Every charge came from Xbox Live, an online gaming site, and totaled several hundred dollars.

She first suspected something was up when her card didnt work to get gas, which prompted me to check our account online where all those charges had just posted. Our checking account was down to about 50 bucks. I called the bank immediately to report it, but in the meantime there were checks out there and a number of purchases wed made in the previous several days that hadnt cleared yet.

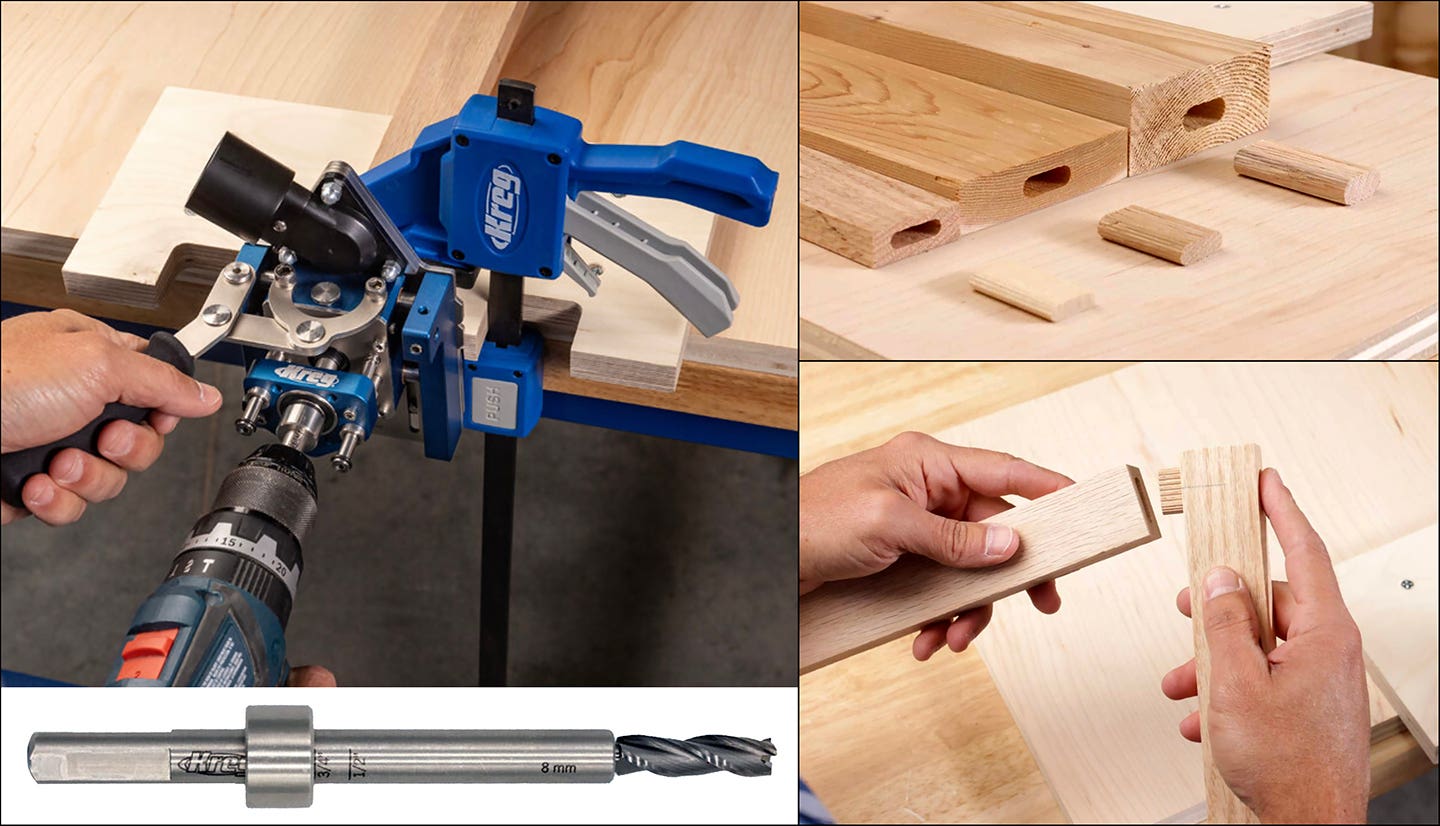

Naturally, the posting that tipped us over the edge was mine. Two purchases, actually, made necessary by my returning to the shop: Some supplies from the local Big Box, and a quantity of really nice walnut from my local wood monger. Now overdrawn, the fees for our overdraft protection start kicking in a $36 courtesy charge for each occurrence. So even though we werent really over the line that much initially, every transaction (including one check for a mere $5.13) incurred the fee when it posted, quickly pushing the account deeper into the red.

So, at the moment were several hundred dollars in the hole from the original theft, plus an even larger amount in overdraft fees. Ugh. The good news is that this ultimately wont cost us anything except a big hassle itll take a week or two, but those fraudulent charges will be erased, and all those $36 penalty fees eventually refunded to our account.

Not a lot of woodworking discussion here this time around, but I think the point Im making here is both simple and obvious: Be careful with your credit cards.

Till next time,

A.J.

A.J. Hamler is the former editor of Woodshop News and Woodcraft Magazine. He's currently a freelance woodworking writer/editor, which is another way of stating self-employed. When he's not writing or in the shop, he enjoys science fiction, gourmet cooking and Civil War reenacting, but not at the same time.